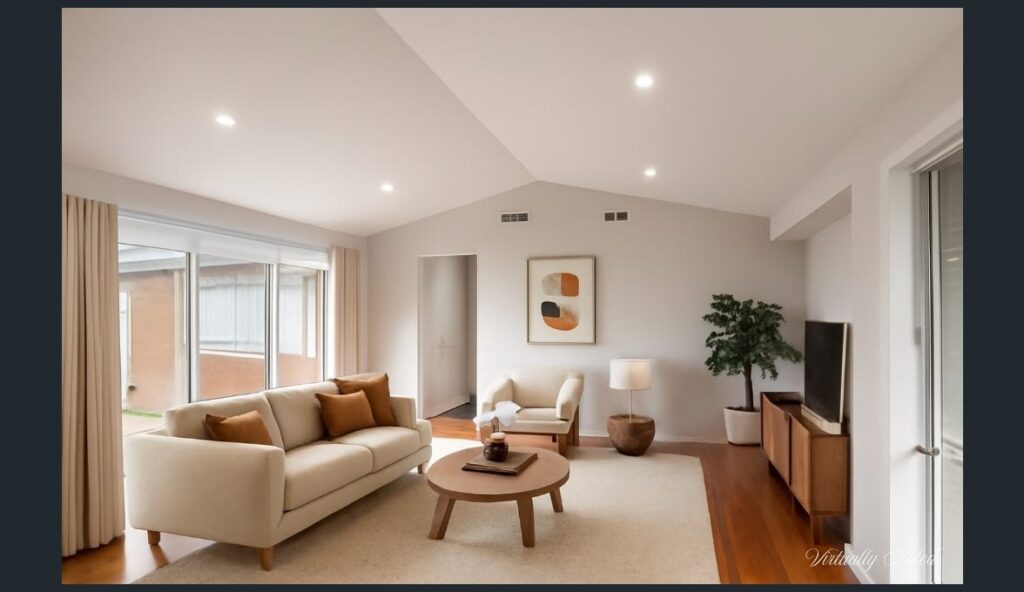

Photo by Pexel

Buying a property off the plan might seem appealing. It’s a big deal in Australia’s growing property market. But, it also brings risks that can hurt your money and peace of mind.

We’ll help you understand the dangers of off the plan buying. You’ll see how these risks can mess with your money and safety. This is just the start of our detailed look at property investment.

For more info or to talk about your situation, visit https://realestate2c.net/ or email us at info@realestate2c.com.au. Or call +61 450 182 008.

Key Takeaways

- Understanding the risks associated with off the plan property buying.

- How these risks can impact your budget and financial security.

- The importance of informed decision-making in property investment.

- Guidance on navigating the complexities of off the plan buying.

- Steps to mitigate possible financial risks.

Understanding Off the Plan Property Purchases in Australia

Off the plan property buying is becoming popular in Australia. But what is it, and why do people like it?

What Does Buying Off the Plan Actually Mean?

Buying off the plan means you buy a property that’s not built yet. You agree to buy it based on plans and details from the developer.

It’s a forward commitment that needs trust in the developer’s plans and timing. As

“The off the plan market allows buyers to invest in properties before they’re built, showing growth from the start.”

Current Trends in the Australian Off the Plan Market

The Australian off the plan market changes with the economy, interest rates, and how confident people are. Now, more buyers are coming in. They’re drawn by the chance for capital appreciation and good rental returns.

Why Buyers Are Attracted Despite the Risks

Buyers see past the risks like delays and price changes. They’re drawn to the chance to buy at today’s price. They hope to sell it for more later or see its increased property value over time.

For more info or to talk about your situation, visit https://realestate2c.net/ or email us at info@realestate2c.com.au or call +61 450 182 008.

Major Financial Risks of Off the Plan Investments

Buying off the plan in Australia has big financial risks. It’s tempting to buy before it’s built. But, you must know the dangers that could hurt your money.

Deposit Requirements and Financing Challenges

One big risk is the deposit needed upfront. This can be a lot of money. Financing challenges might happen if your money situation changes before it’s finished, making loans hard to get.

Valuation Shortfalls at Completion Time

Another risk is valuation shortfalls when it’s done. If the property’s value drops, you might pay more than it’s worth.

Stamp Duty Considerations in Different Australian States

Stamp duty changes in each state. For example, in New South Wales, it’s based on the price. In Victoria, it’s the value at transfer.

Hidden Costs and Fee Structures

There are hidden costs and complex fees too. These include legal fees, inspection costs, and strata fees for apartments.

For more info or to talk about your situation, visit https://realestate2c.net/ or email info@realestate2c.com.au or call +61 450 182 008.

How Construction Delays Impact Your Financial Planning

Buying off the plan in Australia can be risky. Delays in construction can mess up your plans. This can lead to big problems.

Photo by Pexel

Common Causes of Project Delays in Australian Developments

Many things can cause delays in building projects in Australia. Unforeseen site conditions like bad soil or hidden dangers can stop work.

Other reasons include weather events, labour shortages, and regulatory compliance issues. Knowing these can help you get ready.

Financial Consequences of Extended Timelines

Longer building times can mean more money spent. This can hurt your budget. You might pay more interest on your loan.

Delays can also mess with your money flow. This can put a lot of pressure on your finances. As one expert says,

“Delays in construction can have a ripple effect on a buyer’s financial situation, making it important to have backup plans.”

Steps to Take When Facing Significant Delays

If there are big delays, check your contract. Know your rights. You might need to talk to the developer or get a lawyer.

Legal Recourse Options for Australian Buyers

Australian buyers have legal ways to deal with delays. You can ask for compensation or even cancel your contract.

- Check your contract for delay rules

- Talk to a lawyer who knows property law

- Think about joining a buyers’ group for help

For more info or to talk about your situation, visit https://realestate2c.net/ or email us at info@realestate2c.com.au or call +61 450 182 008.

Quality Issues and Specification Changes to Watch For

When you buy off the plan, watch out for quality issues and changes in what’s promised. You’re not just buying a property. You’re also taking on the risk of things not being as promised.

Discrepancies Between Marketing Materials and Reality

The Gap Between Marketing Materials and Reality

Marketing for off the plan properties often shows fancy finishes and cool features. But, the real thing might not match what’s shown. Be careful of materials that seem too good to be true.

Make sure to read your contract and any extra papers carefully. Look for details on materials, fixtures, and fittings. If you’re not sure, ask your lawyer or the developer.

Photo by pexel

Understanding Sunset Clauses and Developer Exit Strategies

Sunset clauses let developers cancel a project if they can’t sell enough or get approvals. While they help developers, they can also leave buyers in a tough spot.

It’s important to know what sunset clauses mean for you. Read your contract well and talk to a lawyer if you’re not sure.

Pre-Settlement Inspection Limitations

Pre-settlement inspections are key when buying off the plan. But, they’re not a full check of the property. They’re a final look to find big problems before you buy.

Documenting Defects and Seeking Remediation

If you find problems during the inspection, write them down well. Take photos and videos as proof. Then, tell the developer and ask them to fix it as your contract says.

For more info or to talk about your situation, visit https://realestate2c.net/ or email us at info@realestate2c.com.au or call +61 450 182 008.

The Psychological Burden of Off the Plan Purchases

Buying off the plan in Australia can really affect your mind. It’s full of waiting and uncertainty. This can be hard for many people.

Managing Stress During the Extended Waiting Period

Waiting for your property can be stressful. Setting realistic expectations helps. Also, talking openly with your developer can ease the pressure.

Coping with Uncertainty and Changing Market Conditions

The Australian property market can change fast. This can impact your purchase. Keeping up with news and having a flexible financial plan helps.

Balancing Excitement with Realistic Expectations

It’s okay to be excited about your new home. But, it’s also key to be realistic. Knowing the risks and challenges helps you handle things better.

| Psychological Challenge | Coping Strategy |

| Stress during waiting period | Regular updates from developer |

| Uncertainty about market conditions | Staying informed about market trends |

| Balancing excitement with reality | Understanding the risks and challenges |

For more info or to talk about your situation, visit https://realestate2c.net/ or email us at info@realestate2c.com.au. Or call +61 450 182 008.

Essential Protective Measures for Off the Plan Buyers

To avoid risks in off the plan buying, you need to take key steps. These steps will help you understand off the plan property investments in Australia better.

Critical Contract Clauses to Negotiate

Negotiating important contract clauses is key. Look at construction timelines, penalty provisions for delays, and specification changes. Strong clauses can protect you a lot.

Conducting Due Diligence on Developers and Builders

Do your homework on developers and builders before buying. Check their track record, past projects, and financial stability. A developer’s past shows their trustworthiness.

“A developer’s history is a strong indicator of their reliability.”

Industry Expert

Creating Financial Buffers and Contingency Plans

It’s important to have financial buffers and plans. Know your financing options and have money for surprises.

Deposit Protection Strategies

Learn about deposit protection strategies. In Australia, deposits are safe in trust accounts or bank guarantees. This gives you peace of mind.

Finance Pre-approval and Reassessment Timelines

Get finance pre-approval early to know your budget. Also, know when lenders will reassess your loan. This affects your final approval.

For more info or to talk about your situation, visit https://realestate2c.net/ or email info@realestate2c.com.au or call +61 450 182 008.

Conclusion: Making Informed Decisions in the Australian Property Market

Buying off the plan in Australia needs careful thought. It comes with financial and emotional challenges. These include deposit costs, delays, and changes in what you get.

To do well in the property market, know the risks. Take steps to protect your money. This means talking about important parts of the contract, checking the developer, and saving extra money.

If you need help with off the plan property, visit https://realestate2c.net/. Or call us at info@realestate2c.com.au or +61 450 182 008. We can guide you to make smart choices for your money and goals.

FAQ

What are the risks associated with buying off the plan in Australia?

Buying off the plan in Australia has risks. These include financial issues like needing a big deposit and facing financing problems. There’s also the chance of the property’s value dropping.Other risks include delays in building, problems with the quality of the property, and changes to what you’ll get.

How do construction delays impact my financial planning?

Delays in building can mess up your financial plans. They can make things take longer, cost more, and change your money plans. It’s key to know why delays happen and how they affect your money.

What are sunset clauses, and how do they affect off the plan buyers?

Sunset clauses let developers cancel deals if things don’t go as planned. It’s important for buyers to know about these clauses to protect themselves.

How can I protect my deposit when buying off the plan?

To keep your deposit safe, learn about how to protect it. This includes using trust accounts and other ways to keep your money safe until the property is ready.

What steps can I take if I encounter quality issues or specification changes?

If you find problems with the property, document them and ask for fixes. Knowing how to inspect the property before you buy can help you spot issues early.

How can I manage stress and uncertainty during the off the plan buying process?

To handle stress and uncertainty, understand the process and know the risks. Keeping your expectations realistic helps too. Having a financial safety net can also reduce stress.

What are the key contract clauses to negotiate when buying off the plan?

When buying off the plan, negotiate important parts of the contract. This includes clauses about when the property will be ready, its quality, and what the developer must do.

How can I conduct due diligence on developers and builders?

To check on developers and builders, look into their past work, money situation, and reputation. This helps you understand the risks and make a better choice.

What is the importance of finance pre-approval when buying off the plan?

Getting finance pre-approval is key when buying off the plan. It shows how much you can borrow and helps you plan your finances. It’s also important to keep checking your pre-approval to stay ready for changes.