Photo by: GM LAW

Investing in off-the-plan properties seems good in the Australian property market. But have you thought about all the costs? There are many hidden costs that can add up fast. Here’s why you should never buy off the plan property.

When you buy off-the-plan properties, you might just look at the price. But there are other costs you need to know about. We’ll show you the possible problems and help you make a better choice.

Want to know more or talk about your property plans? Contact us at info@realestate2c.com.au or WhatsApp: +61450182008.

Key Takeaways

- Understanding the full cost of off-the-plan properties, including hidden costs.

- The importance of considering all expenses when investing in the Australian property market.

- How to avoid unexpected financial burdens when purchasing off-the-plan.

- Tips for making informed decisions when investing in property.

- Factors that can impact the total cost of your property investment.

The Alluring Promise of Off-The-Plan Properties

Off-the-plan properties are exciting because they promise new designs and good investment returns. Many Australians, including first home buyers, find this idea very appealing. It lets them buy a new home or investment with the latest features.

These properties are marketed with big promises. Developers say they need less money down and can grow in value. They talk about new designs, saving energy, and being close to public transport and shops.

The Marketing Pitch vs. Reality in Australian Developments

The marketing for these properties focuses on a better lifestyle and money gains. But, it’s important to check if these promises are true. Some properties do well and offer luxury, but others might not meet expectations.

It’s key to think carefully and do your homework. Make sure the property fits your goals and what you want.

Initial Deposit and Stamp Duty Advantages

Buying off-the-plan means you might only need to pay 10% down. This makes it easier for first home buyers to get into the market.

Also, some states offer stamp duty breaks for first home buyers. This can lower the costs of buying a property.

First Home Buyer Incentives and Depreciation Benefits

First home buyers might get government help, like the First Home Owner Grant. For investment properties, you can claim depreciation. This means you can write off the value of some assets over time.

Knowing about these benefits can help you make more money. It’s smart to talk to financial advisors or property experts to use these incentives well.

Hidden Costs That Balloon Your Investment

Buying off-the-plan can have hidden costs. The first price might look good, but other things can make it more expensive. It’s important to know all the costs.

Photo by Pearl Financial

Sunset Clause Exploitation by Developers

The sunset clause is something to watch out for. It lets developers cancel the deal under certain conditions. This can lead to extra costs or changes in the deal for buyers.

Unexpected Strata and Body Corporate Fees

Strata and body corporate fees are another hidden cost. These fees pay for the upkeep of shared areas. But, they can be more than you think, and some costs might surprise you. Make sure to include these in your budget.

- Strata fees can change a lot based on the building and its location.

- Some fees are for special maintenance or upgrades.

- Knowing the strata management statement can help you guess future costs.

Finishing and Fixture Upgrades

Finishing upgrades can also increase your property’s cost. Developers usually offer basic finishes. But, you might want to choose better materials and fixtures.

Standard vs. Premium Finishes in Australian Apartments

Standard and premium finishes have big price differences. Premium finishes use top materials and fixtures. They make your property look better and worth more, but they cost more too.

The Cost of Customisation and Variations

Changing your property can also cost a lot. Think about the benefits and costs. Ask yourself if these changes fit your long-term plans.

To avoid surprises, do the following:

- Check the contract for any clauses that might add extra costs.

- Look up average strata and body corporate fees for similar places.

- Think about finishing and fixture upgrades when planning your budget.

Knowing about these hidden costs helps you make a better choice. It’s not just the first price. It’s about knowing the total cost of your investment.

Why You Should Never Buy Off The Plan: Market Risks and Valuation Issues

Thinking about buying an off-the-plan property? It’s important to know the risks. There are many things to think about before you decide.

Property values in Australia can change a lot. These changes can affect how much your investment is worth by the time it’s ready.

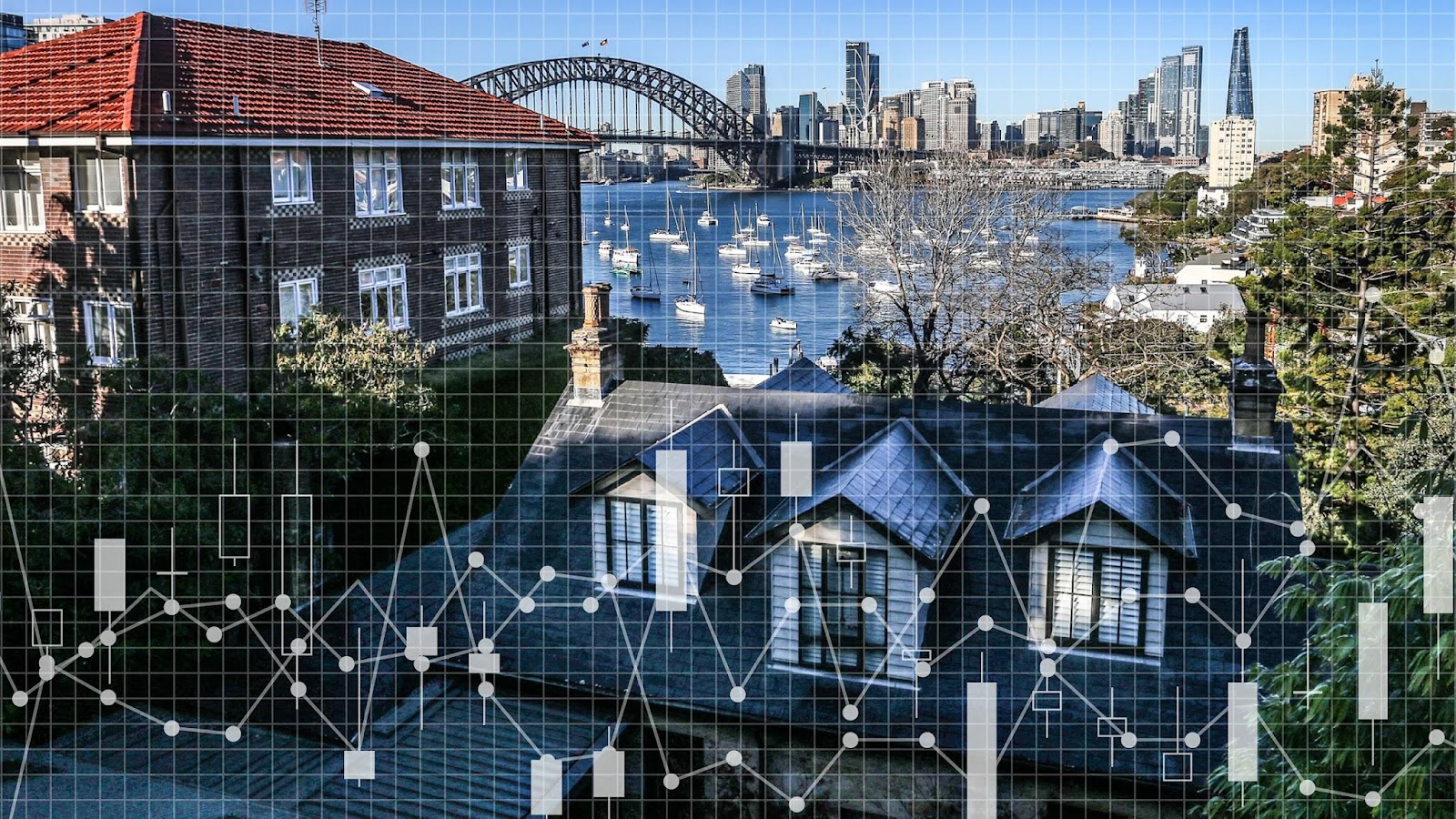

Property Value Fluctuations in Australian Markets

Photo by Nikkei Asia

The Australian property market is very changeable. Things like the economy, government rules, and what people want can change property values. For example, if the economy goes down, property values might drop too.

To avoid these risks, keep up with market trends. Knowing what’s happening in the market can help you make a better choice.

Financing Challenges with Australian Lenders

Getting a loan for an off-the-plan property can be hard. Lenders might ask for more money down or have stricter rules. This can be tough for first-time buyers or those with less financial history.

Talking to financial advisors is a good idea. They can help you understand your loan options and what challenges you might face.

The Bank Valuation Gap Problem

Buying off-the-plan can also lead to a bank valuation gap. This happens when the lender thinks the property is worth less than you paid for it.

What Happens When Valuations Fall Short at Settlement

If the bank’s valuation is lower than the price you paid, you’ll have a problem. You’ll need to find extra money to cover the difference. For example, if you paid $500,000 but the bank says it’s worth $450,000, and you have a $400,000 loan, you’ll need $50,000 more.

Finding Extra Funds When Your Loan Doesn’t Cover the Purchase

Finding extra money for a valuation gap can be hard. You might need to look for other loan options or talk to the seller. Sometimes, you might have to think again about buying.

To deal with these issues, understanding the market and your finances is key. We suggest you think carefully about your financial situation and get professional advice before buying off-the-plan.

Quality and Delivery Disappointments

Buying off-the-plan comes with big risks. You’re not just buying a property. You’re also trusting in its quality and timely delivery. But, things don’t always go as planned.

Construction Delays and Their Financial Impact

Construction delays are common in off-the-plan buys. These delays can hit your wallet hard. They can push back your moving date and add extra costs.

For example, if you’re selling your old place to move into the new one, delays can be a big problem. You might end up with two mortgages at once. This can really strain your finances.

Delays can happen for many reasons. Weather, lack of workers, or financial problems with the developer are just a few. No matter the cause, the impact on you can be big.

Quality Control Issues in High-Density Developments

Quality control is a big worry. High-density projects often face quality control issues. Problems can include construction defects, poor finishes, and issues with fixtures and fittings.

- Construction defects can lead to structural problems.

- Poor finishes can make the property look bad and less livable.

- Fixtures and fittings issues can cost a lot to fix.

Defect Rectification Costs and Legal Remedies in Australia

If you find defects or quality issues, knowing your rights is key. In Australia, buyers have legal protections. These include the right to have defects fixed. But, fixing these problems can cost a lot.

It’s important to know your legal options. These include:

- Taking legal action against the developer or builder.

- Seeking compensation through the courts.

- Using any warranties or guarantees that apply.

Understanding these issues and legal protections can help you make a better choice when buying off-the-plan.

Conclusion: Protecting Yourself in the Australian Property Market

Buying off-the-plan properties in Australia can be tricky. The first deposit might seem good, but there are hidden costs. Market changes and quality issues can also be problems.

It’s important to know these risks before buying. This way, you can make a better choice.

For help, talk to a professional. They can guide you through the market. You can contact us at info@realestate2c.com.au or +61450182008 on WhatsApp.

Being careful and informed helps you make good choices. Understanding risks is key to protecting yourself in the Australian property market.

FAQ

What are off-the-plan properties?

Off-the-plan properties are homes or buildings you buy before they’re built. You sign a contract with the developer. This contract is based on the plans and details they provide.

What is a sunset clause, and how can it affect me?

A sunset clause lets the developer cancel the project if they don’t meet certain conditions. This could be if they don’t get the needed approvals or sell enough units. It might affect you if the project is cancelled or delayed.

What are strata and body corporate fees, and how are they calculated?

Strata and body corporate fees are for maintaining common areas in a building. They’re based on the size and type of your property. Each property pays a share based on its unit entitlement.

How can I avoid unexpected costs when buying off-the-plan?

To avoid surprises, read your contract carefully. Understand all fees and charges. Research the developer and look for hidden costs. Getting professional advice is also a good idea.

What happens if the property’s valuation is lower than the purchase price at settlement?

If the property’s value is less than what you paid, you might have to pay the difference. Or you might need to renegotiate your loan. This is called a bank valuation gap and can be a big problem.

What are my options if the developer delays the construction or delivers a defective property?

If there’s a delay or the property is not as expected, you might get compensation. You can also go to court. It’s best to get advice on what to do next.

How can I get in touch with real estate experts for advice on buying property in Australia?

You can email us at info@realestate2c.com.au or WhatsApp us at +61450182008. We offer expert advice on the Australian property market.